mississippi income tax calculator

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The Mississippi Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Mississippi State Income Tax Rates and Thresholds in 2022.

How To Create An Income Tax Calculator In Excel Youtube

If you make 137500 a year living in the region of Mississippi USA you will be taxed 34199.

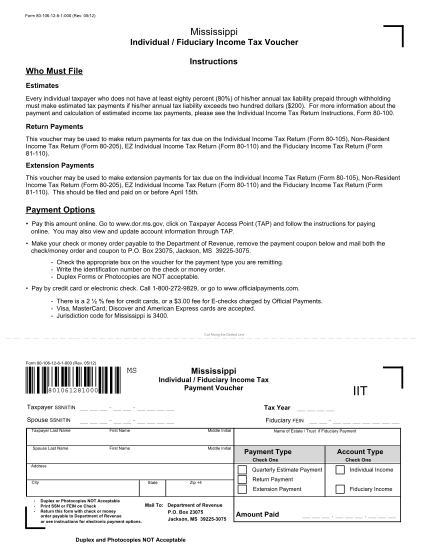

. The Mississippi tax calculator is updated for the 202223 tax year. Mississippi Code at Lexis Publishing Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 Income Tax Regulations Title 35 Part III Mississippi Administrative Code. Your average tax rate is.

The Mississippi income tax calculator is designed to provide a salary example with salary deductions made in. Information on Available Tax Credits. Mississippi Income Tax Forms.

- Mississippi State Tax. This tool was created by 1984 network. The countys average effective tax rate is just 076.

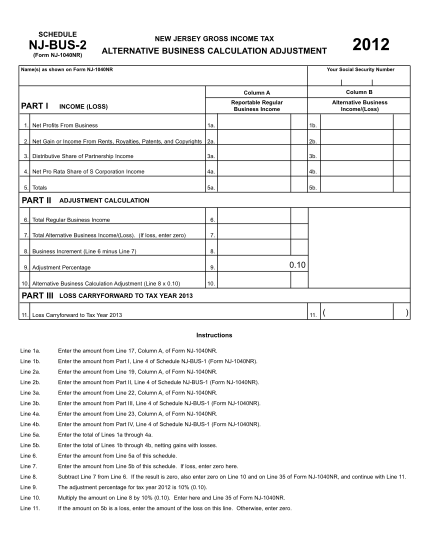

The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. Withdrawals from retirement accounts are not taxed. Mississippi Income Tax Calculator 2021.

The state income tax system in. Below are forms for prior Tax Years starting with 2020. The MS Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MSS.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Mississippi Salary Paycheck Calculator. After entering it into the calculator it will perform the following calculations.

Situated on the Gulf of Mexico in southern Mississippi Harrison County has tax rates slightly below state averages. Mississippi residents are subject to state personal income tax. Married Filing Joint or Combined.

Marginal tax rate 24. - FICA Social Security and Medicare. Quick Guide to Mississippi Retirement Income Taxes.

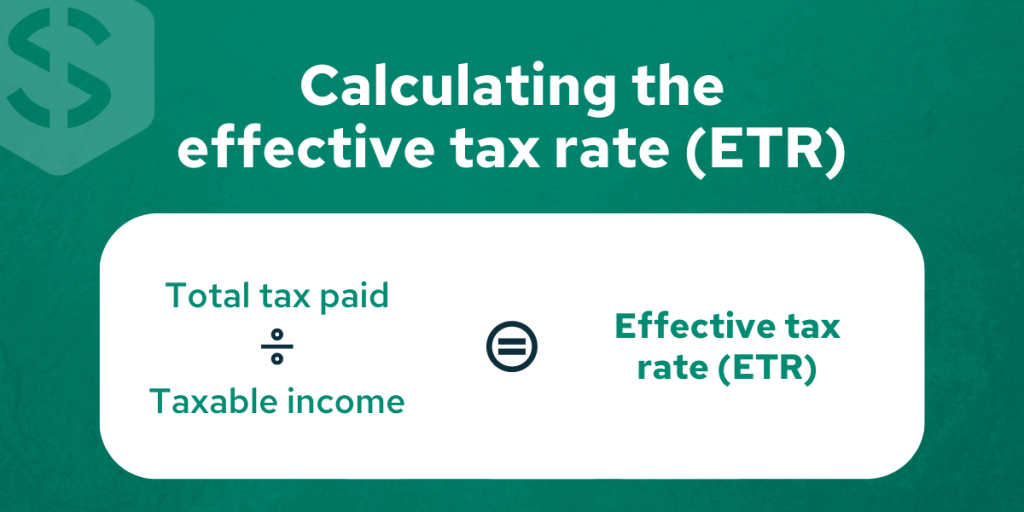

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Average tax rate. Created with Highcharts 607.

Below is listed a chart of all the exemptions allowed for Mississippi Income Tax. Details of the personal income tax rates used in the 2022 Mississippi State Calculator are published below the. How many income tax brackets are there in Mississippi.

If you would like to help us out donate a little Ether cryptocurrency. Wages are taxed at normal rates and your marginal state tax rate is 00. 2300 exactly 12 of the 4600.

Mississippi does allow certain deduction amounts depending upon your filing status. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Thankfully our Mississippi state tax calculator is a simple accurate way to calculate your tax liabilities in the Magnolia state.

The higher income Mississippi taxpayers bring in. Your average tax rate is. Our calculator has been specially developed.

The Mississippi hourly paycheck calculator will show you the amount of tax that will be withheld from your. These back taxes forms can not longer be e-Filed. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

You can use our free Mississippi income tax calculator to get a good estimate of what your tax liability will be come April. Mississippi Income Tax Calculator 2021. Calculate your Mississippi net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Mississippi paycheck calculator.

This income tax calculator can help estimate your average income tax rate and your salary after tax. Our income tax and paycheck calculator can help you understand your take home pay. The taxable wage base in 2022 is 14000 for each employee.

Box 23050 Jackson MS 39225-3050. Filing 5500000 of earnings will result in 508750 of that amount being taxed as federal tax. You will be taxed 3 on any earnings between 3000 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000.

A homeowner facing that rate with a home worth 150000 would. You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202223. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

Calculate your net income after taxes in Mississippi. Details on how to only prepare and print a Mississippi 2021 Tax Return. Free for personal use.

Your household income location filing status and number of personal exemptions. Mississippi Income Tax Calculator 2021. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Mississippi is very tax-friendly toward retirees. If you make 199000 in Mississippi what will your salary. Mississippi uses a graduated income tax bracket system which means tax rates are structured according to income.

Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on time you get a 90 tax credit on FUTA. Mississippis SUI rates range from 0 to 54. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

Social Security income is not taxed. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 2022 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Switch to Mississippi hourly calculator. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Because the income threshold.

On the next page you will be able to add more details like itemized deductions tax credits capital gains. The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income. Mississippi Salary Tax Calculator for the Tax Year 202223.

Filing 5500000 of earnings will result in 420750 being taxed for FICA purposes. All other income tax returns P.

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi Tax Rate H R Block

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Mississippi Income Tax Calculator Smartasset

Mississippi Income Tax Calculator Smartasset

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi Tax Rate H R Block

Sales Tax By State Is Saas Taxable Taxjar

Mississippi State Income Tax Ms Tax Calculator Community Tax

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

18 Income Tax Refund Calculator Page 2 Free To Edit Download Print Cocodoc

Federal Tax Calculator 2022 23 2022 Tax Refund Calculator

Income Tax Calculator Estimate Your Refund In Seconds For Free

Effective Tax Rate 101 Calculations And State Rankings Savology

Tax Rates Exemptions Deductions Dor

Mississippi State Income Tax Ms Tax Calculator Community Tax

1040 Tax Calculator United Mississippi Bank

18 Income Tax Refund Calculator Page 2 Free To Edit Download Print Cocodoc